Standard & Poor’s cut the Russian Federation sovereign debt credit rating citing the capital flight and risk to investment in the wake of the Ukraine crisis. S&P lowered Russia’s sovereign debt rating from BBB to BBB- placing it one notch above junk status.

Russia’s economy has slowed in step with the rest of the BRICs (Brazil, Russia, India, China). As the global economy entered recession in 2008, the BRICs were one of the few remaining bright spots still generating economic growth. For a variety of reasons tied to specific national and global macro conditions all BRICs economic growth has slowed considerably.

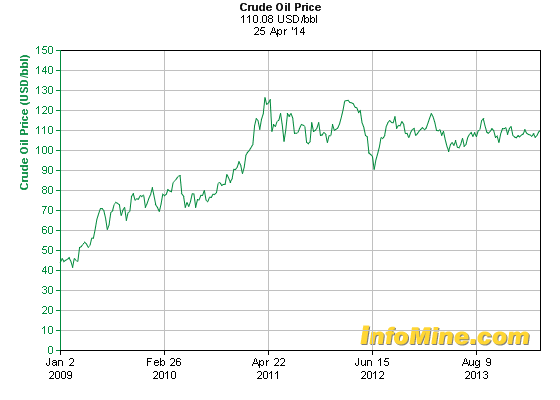

Russia’s fortune was closely tied to energy exports. The devaluation of the US dollar and acute political risk heightened by wars in Afghanistan, Iraq and Syria; and the uncertainty surrounding the impact of events in Libya, Egypt and Iran had supported a rich valuation of oil prices.

New sources of fossil fuels coming online in North America, Libya, Iraq and Iran has undermined oil prices. Political instability in Venezuela and the fracturing of Russia’s paternalistic relationship with Ukraine and the potential disintermediation of Russian oil exports to its largest market in the EC adds a new uncertainty to global energy markets. It may also serve to support the rich valuation for oil even as supply expands.

In its commentary, S&P notes the rising debt burdens of Russian Federations Local and Regional Governments, slowing domestic growth, over dependency on energy exports and the developing conflict with Ukraine as reasons for the downgrade.

Turning business cycles create powerful macroeconomic risk factors that challenge SMEs. Rapidly changing market dynamics surface grave threats to SMEs. The Ukrainian Crisis is a risk event that impacts the cost of capital for the global SME community, spikes increase in commodity prices and disrupts global supply chains and market access. Acute macro risk drivers force market players to compete for capital in realigning markets. How will this global risk event impact your business? SME's must continually assess market events to seize emerging market opportunities.

Get risk aware with MERA, a Macroeconomic Risk and Event Assessment app available on Google Play. MERA's Mobile Office capabilities provides business managers a world class risk management tool to assess emerging risk factors to adapt and capitalize on the opportunities shifting markets present.

risk: Russian Federation, EU, Ukraine, commodities, oil, Standard & Poor's, sovereign debt, credit risk, SME lending, market dynamics, macroeconomics

You need to be a member of Global Risk Community to add comments!

.png)

Comments