In Asia, REITs are gaining popularity because both Singapore and Hong Kong have performed very well in recent years as recipients of real estate investors from markets such as China, the Philippines and Indonesia due in large part of central bank policy which target the U.S. dollar directly in the case of Hong Kong, or U.S. interest rate policy, in the case of Singapore.

REITs continue to attract investors because their dividends are more appealing than other investment opportunities in the current low interest rate environment. The search for yield has created a near mania in equity markets. Many institutional investors switched to the REIT market in recent years away from property developer stocks because of the higher policy risk in their home markets. Singapore has 16 REITs with a market capitalization of $19.3 billion, compared with Hong Kong's 7 REITs presently valued at $8.8 billion. Hong Kong is losing the mainland REIT market to Singapore.

At the moment it s more attractive to be a Singapore REIT than a Hong Kong REIT, said Alastair Gillespie, co-head of Asian real estate research at UBS. Singapore REITs offer the highest yields, both on an absolute basis and in comparison to the country's five-year government bonds -- topping even Australia and Hong Kong. And this, again, is due to the Monetary Authority of Singapore's policy of aping the Fed's interest rate policy. With the Fed holding interest rates down near zero out to 3 years, it is no wonder that S-REITs pack such a favorable spread, even with Singapore's GDP growing very slowly.

The poor showing of REITs in Hong Kong might be that developer sponsors took a short-term view and packaged REITs primarily to divest real estate at the best prices they could get. Singaporean sponsors, on the other hand, have focused on creating acquisitive investment vehicles with defined long-term growth plans. They have also transferred assets into the REITs at more attractive prices, creating value for investors.

Exchange | Company | Yield |

SGX | Sabana REIT | 7.19% |

SGX | Frasers Centrepoint REIT | 4.70% |

SGX | CapitaRetail REIT | 5.30% |

SGX | Cambridge REIT | 5.88% |

SGX | Starhill Global REIT | 5.68% |

HKG | Link REIT | 3.09% |

HKG | Champion REIT | 5.07% |

HKG | Hui Xian REIT | 5.82% |

HKG | Sunlight REIT | 4.86% |

Singapore REITs' income is growing despite Singapore's slowing economic growth partly because many are trading above their net asset values, allowing them to issue equity to finance acquisitions. The FTSE ST REIT index tacked on 5.1% in the first quarter and was up 30.7% for year ending March 31. Meanwhile, leases signed during the global financial crisis are now being renewed at higher rates and many Singapore REITS have begun buying assets outside the land-starved city-state. Singapore has become the second most active purchaser of foreign real estate after Japan in Asia; buying assets in Australia, China, Japan, Malaysia and South Korea, according to CBRE Group Inc.

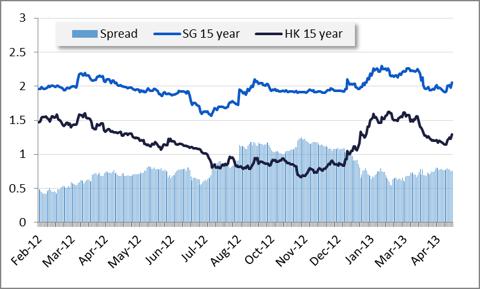

More flexible regulators and lower interest rates make Singapore the preferred place to list. Singapore has created tax breaks to encourage the listing of REITs, while in Hong Kong, REIT assets are taxed the same way as if they were owned by a company. Singapore REITs' dividends are tax-free provided more than 90% of the firm's income is distributed to investors. No such tax transparency exists for Hong Kong's REITs; they have not gained the same attractions as they have in Singapore. Furthermore, under its Linked Exchange Rate System, Hong Kong's REITs closely track that of the U.S. because of the currency peg. In line with slowly rising U.S. Treasury yields, Singapore's 15-year bond yield has risen to 2.09 % and Hong Kong's to 1.34%. The average yield of 5.13% for Singapore REITs Index is far more attractive than 3.47 % offering in Hong Kong's in a long run. But REIT investors need to watch rising yields on long-term bond yields.

So far, the Fed has been able to engage in QE and have foreign central banks not revolt at the money printing. The latest T.I.C. report shows that both Singapore and Hong Kong have been buyers of U.S. treasury debt since December -- at least through March -- and the start of QEIII/IV. But, in doing this, property valuations around the region are becoming bloated.

As a consequence of running out of real estate, many of these REITs have had to go offshore. The dual primary listing in Singapore and Hong Kong provides a REIT unitholder the flexibility to trade their units on both exchanges, widening the investor base of REIT and providing access to increased liquidity of the units. Fortune REIT, for example, listed in Singapore in 2003 and Hong Kong in 2010 and more REITs are expected to cross-list in these two countries. Moreover, ASEAN Link is creating greater liquidity regionally, allowing Singaporean, Malaysian and Thai stocks to be traded across all three exchanges.

Singapore sets itself apart with its pipeline of strong sponsors and the framework to support REIT listings. Singapore is especially appealing to property owners in countries without proper REIT frameworks such as India, Indonesia, and China where properties may have been trading at below asset value. And we're now seeing both Singapore and Hong Kong REITs branching out into mainland Chinese assets like CapitaLand's (CLLDF.PK) CapitaRetail China Trust. Moreover, Singapore can encourage cross-border REITs with southern Malaysia, one of the fastest growing places in the world because of its proximity to Singapore and special incentives put in place by Malaysia to develop the Iskandar region of Johor State.

Where this may become more interesting is Hong Kong moving to offer the first yuan-denominated REIT outside of China in April. Hui Xian Real Estate Investment Trust, which is aiming to raise up to ¥ 11.2 billion, selling 40% of the company priced between ¥5.24 to ¥5.58 per share. Hong Kong's Securities and Future commission (SFC) has become more accommodating with the last few REITS brought to market. Hong Kong regulations impose restrictions on aggregate borrowings of a REIT, which shall not exceed 45% of the total gross asset value of the REIT while Singapore limits at 35% of the deposited property.

With China making noise about allowing full convertibility of the yuan (CYB) by the end of the year, this is yet another example of the increased presence of the yuan in international finance. With the relentless rise in the yuan this year -- now trading below ¥6.14 up 1.6% year-to-date-this adds currency arbitrage to the valuation equation further eroding the value proposition of Hong Kong Dollar-denominated REITs versus Singapore's as the Singapore Dollar (FXSG) is more closely tied to movements in the yuan than the dollar over the past year. The iShares MSCI Singapore Index ETF (EWS) has far lower exposure to real estate, 15.9% of $ 1.65 billion AUM while real estate accounts for 33.4% of the iShares MCSI Hong Kong Index ETF's (EWH) $ 3.63 billion AUM. EWS's has risen 7% YTD, paying a 3.72 % dividend, while EWH has returned 4% with a 2.42 % yield.

Singapore has more flexibility going forward than Hong Kong as a currency peg is far stricter than the MAS' approach, which makes it much more vulnerable to Federal Reserve policy.

Comments