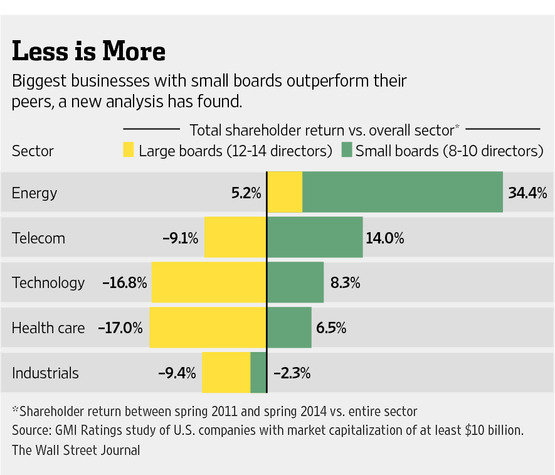

According to a new study by GMI Ratings, bigger isn’t always better in the boardroom. In research for the Wall Street Journal, analysts found that large companies with the smallest boards produced substantially better shareholder returns. Based on a study of 400 companies with a market capitalization of at least $10 billion, those with small boards outperformed their peers by 8.5 percentage points, while those with large boards underperformed peers by 10.85 percentage points. The smallest board averaged 9.5 members, compared with 14 for the largest. The average size was 11.2 directors for all companies studied, GMI said. Their results were replicated across 10 different industries, from energy to healthcare. Smaller boards tend to be “decisive, cohesive, and hands-on,” the WSJ noted, with more freedom to delve deep on operational issues and substantively debate issues. Further, as NYU finance professor David Yermack told the paper, small boards are more likely to dismiss CEOs for poor performance—a threat that declines significantly as boards grow. While the details of causality are up for debate, the correlation is striking. Apple, which expressed firm plans to limit the board to 10 people, outperformed competitors in the technology sector by 37% between 2011 and 2014. Helmed by just seven directors, Netflix outperformed its industry peers by 32% during the same period. By contrast, pharmaceutical giant Eli Lilly, which has a board of 14, trailed its peers in the healthcare sector by 16% |

You need to be a member of Global Risk Community to add comments!

Comments