https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=300%2C94&ssl=1 300w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=150%2C47&ssl=1 150w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=768%2C240&ssl=1 768w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=1536%2C480&ssl=1 1536w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=2048%2C639&ssl=1 2048w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=900%2C281&ssl=1 900w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=260%2C81&ssl=1 260w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=600%2C187&ssl=1 600w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?w=1460&ssl=1 1460w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?w=2190&ssl=1 2190w" alt="" width="730" height="228" data-attachment-id="25541" data-permalink="https://riskacademy.blog/understanding-the-risk-profile-is-the-most-important-step-in-insurance-decisions-so-why-isnt-everyone-doing-it/picture1-5/" data-orig-file="https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?fit=3898%2C1217&ssl=1" data-orig-size="3898,1217" data-comments-opened="1" data-image-meta="{"aperture":"0","credit":"","camera":"","caption":"","created_timestamp":"0","copyright":"","focal_length":"0","iso":"0","shutter_speed":"0","title":"","orientation":"0"}" data-image-title="Picture1" data-image-description="" data-image-caption="" data-medium-file="https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?fit=300%2C94&ssl=1" data-large-file="https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?fit=730%2C228&ssl=1" data-recalc-dims="1" data-lazy-loaded="1" />

https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=300%2C94&ssl=1 300w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=150%2C47&ssl=1 150w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=768%2C240&ssl=1 768w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=1536%2C480&ssl=1 1536w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=2048%2C639&ssl=1 2048w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=900%2C281&ssl=1 900w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=260%2C81&ssl=1 260w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?resize=600%2C187&ssl=1 600w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?w=1460&ssl=1 1460w, https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?w=2190&ssl=1 2190w" alt="" width="730" height="228" data-attachment-id="25541" data-permalink="https://riskacademy.blog/understanding-the-risk-profile-is-the-most-important-step-in-insurance-decisions-so-why-isnt-everyone-doing-it/picture1-5/" data-orig-file="https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?fit=3898%2C1217&ssl=1" data-orig-size="3898,1217" data-comments-opened="1" data-image-meta="{"aperture":"0","credit":"","camera":"","caption":"","created_timestamp":"0","copyright":"","focal_length":"0","iso":"0","shutter_speed":"0","title":"","orientation":"0"}" data-image-title="Picture1" data-image-description="" data-image-caption="" data-medium-file="https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?fit=300%2C94&ssl=1" data-large-file="https://i0.wp.com/riskacademy.blog/wp-content/uploads/2022/08/Picture1.png?fit=730%2C228&ssl=1" data-recalc-dims="1" data-lazy-loaded="1" />

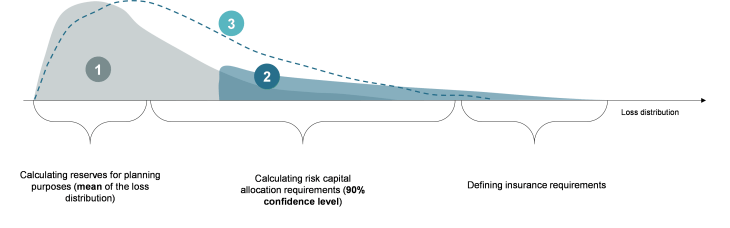

In risk management there is a concept that will be useful for any business out there, it is called – EXPECTED LOSSES. This means that certain risks are inevitable and will occur no matter what. Stealing in retail, foreign exchange fluctuations or customer bad debts are all examples of losses that happen all the time. Some companies have more losses, others have less, but no company has zero risk.

This is a very important concept for any size business because it reminds us that certain losses are inevitable and must be budgeted upfront. No point pretending interest rates are stable or that incidents don’t occur just to keep budgets low.

First useful technique require business to review historical losses to see what losses or delays are almost inevitable and include them into current plans, budgets and forecasts. Keep in mind that history is never a good enough representation of the future, so adjustments will need to be made. For example Archer Insight makes it easy to convert risks into bow ties and bow ties into quantitative risk profile. Expected losses are automatically calculated and can be aggregated.

Check that business can survive plausible worse case scenarios

Second useful concept is called UNEXPECTED LOSSES, PLAUSIBLE WORSE CASE SCENARIO OR VALUE AT RISK(VaR). Every so often, usually once or twice a year or whenever makes sense for your business, companies should check whether they have sufficient liquidity in case significant risks happen.

Scenario analysis is a useful technique here. It allows management to test various what if scenarios. What if sales drop more than expected or costs go up more that ever before or certain markets become completely unavailable. Running scenarios is a great way to test how resilient is your business plan. Checking assumptions used in business planning is a great way to determine what scenarios should be tested.

Have plan B,C and D just in case

Some risks are known and expected, that’s expected losses. Some risks are known but rare and unexpected, that’s unexpected losses. And there some risks that are completely unknown and a total surprise for management. It is difficult to prepare for them specifically, so instead management should develop a set of responses, plans B, C and D in case something completely unexpected happens or unexpected losses are much worse than anticipated.

Comments