The U.S. dollar is losing its status as the world's reserve currency. It's not happening all at once, but slowly and methodically as the dollar is used to settle international trade less and less. The Federal Reserve continues to rig the markets to foster weakness in gold (GLD) prices through a combination of continued ETF outflows and upheaval in the foreign exchange markets created by the debasement of the Japanese Yen (FXY) to support the notion of a strong dollar. This has sparked tremendous short activity in the futures markets and simultaneous unprecedented demand in the physical market. This has eroded the conviction for holding securitized gold and has given cover to economists' forecast for an acceleration in U.S growth later this year.

If gold isn't rising there is no inflation. Gold isn't rising in response to QE. That has been the bearish argument all year. And since the futures market sets the price - or more accurately, has always set the price - bear arguments for gold that defy logic because of the data. But that is changing and we believe the change will begin to occur rapidly the longer the futures price stays near current levels.

The change will come as the physical market becomes the market that sets the price while the futures market crashes.

The Federal Reserve's policy of printing $1 trillion annually in order to support the impaired balanced sheets of banks and to finance the federal deficit was challenged by a steadily rising gold price. Since the beginning of the program the Fed's spokespeople have been talking about ending it. This is simple propaganda and disinformation. As we showed in a previous article the Fed has been accelerating the growth of total credit it is issuing which comes from the expansion of the monetary base and, by proxy, the Fed's balance sheet. In other words QE on a monthly basis has been accelerating, not tapering off. So, listening to the Fed governors tell us that it will back off of QE should be met with more of a "Show Me" attitude than it has.

Global gold demand in the first quarter of 2013 fell by 18% to 932 tons compared to last quarter of 2012. However, the world is witnessing aggressive buying physical gold with a 12.8% increase in demand for jewelry, bars and coins. In Asia, gold is a revered asset class which has helped preserve the wealth of generations who remember all too well hyperinflation and war. U.S export data for December showed an exodus of privately owned gold from the United States into emerging economic powers, such as China, India and Hong Kong which can be attributed to the growing number of gold vaults and new precious metals investment products available.

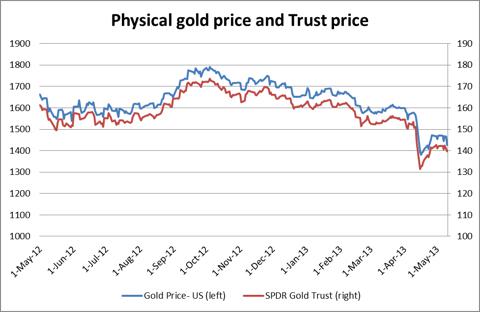

The continued discount between the GLD and the futures price of gold still points to erosion of the quality of the assets backing the GLD and if it widens, we'll know that the trust does not actually have the gold it says it has.

Gold demand in China jumped to a record in the first quarter as sentiment regarding the country's economy underpinned consumption during the Lunar New Year coupled with prices breaking back below $1,700 per ounce. Consumption reached 294.3 tons in the first three months, up 20% from a year earlier, accounting for 26.7% global demand. The appreciating Yuan (CYB) has helped Chinese demand as well, trading currently at ¥6.134, an all-time high. Chinese investors, discouraged by the weak domestic stock market, increasingly relied on gold to fulfill their investment needs.

Similarly, gold demand in India, the world's largest consumer, rose by 27% to 256.5 tons in the first quarter, despite the government's desperate attempts to place curbs and roadblocks on gold importation. Frankly, Indians do not care about these things and as we get deeper in the year and closer to the wedding season, physical demand is only going to rise. This will only continue to fuel a black market in gold imports and raise the premiums paid. In particular, total jewelry demand rose by 15% to 169.5 tons from 138.3 tons, while investment demand increased by 53% to 97 tons.

But, the price of gold is not set by raw demand numbers, it is set more by the expectation of future demand and right now those expectations are at all-time highs. So, why is the price under pressure? Because the monetary system needs it to be dropping. A rising gold price destroys the status quo and calls into question the efficacy of policy. Prices do not fall when demand is rising naturally. Demand only rises like we have seen when prices are being made to move artificially away from equilibrium.

Simply put, the current gold market structure looks exactly like a price ceiling mismatch from a first semester economics class. And like all government-imposed price ceilings the ends are argued to justify the means. The ends in this case is the illusion of economic stability and soundness of the valuation of most financial assets and the means is the suppression of the price of gold.

Here's some more data. Vietnam bought some $4.4 billion worth of foreign currencies, mostly US dollars to import about 100 tons of gold bars which still can't keep up with demand. Imports were up 700% in Q1 according to the Minister of Industry and Trade. We are seeing 20% premiums here now, significantly higher than the 7-11% seen in earlier months. Premiums for gold bars also rallied to all-time highs in Hong Kong and Singapore on May 16. Hong Kong fetched premiums of up-to $5 an ounce over spot London prices while Singapore's were lifted to $3.5 an ounce. Central banks of Russia, South Korea, Kazakhstan and Azerbaijan continue to buy gold to add to their reserves.

The disconnect between physical gold and paper gold gets greater. The first quarter saw ETF outflows equating to a 7% decline in total AUM. The speculation is that a number of shareholders moved to redeem shares for physical metal while other rumors have the gold flowing to the NY vault of JPMorgan (JPM) to prop up its eligible reserves on the COMEX. Money managers, including hedge funds, pulled $1.4 billion from the US gold futures market for the week ended May 14 by trimming their net long position in the metal.

But the over-riding question is where did the gold go? It's not in the vaults at the COMEX which are at historic lows. More than 300 tons have flowed out of GLD but more than three times that amount has been imported by China. The U.S. exported more than three times the amount of gold it mined in Q1. Do you not think that the COMEX gold was a part of that? Or do you think it's sitting around waiting to be bought?

A great number of countries look at moving away from the dollar not only include BRICS but also Japan, Australia and most of Southeast Asia -Thailand and the aforementioned Vietnam. Strong outflows and foreign demand will reach their limit and the current policy of managing the dollar's declining role through gold suppression will end. Sitting out there is the yuan and the latest update to China's gold reserves, which will be revealed to the world when it is most damaging to the U.S. Dollar, especially if the current policy to isolate the yuan as the only appreciating currency versus the dollar goes too far. All China has to do is declare that they have 3,000 or 4,000 tons of gold backing the yuan and the entire market changes overnight. For now China is content to catch gold bars falling from the COMEX and LBMA at fire sale prices. Investors should fortify their portfolios accordingly.

Comments