Vietnam's central bank cut interest rates again last week as inflation slowed, joining central banks from Sri Lanka and Australia to the ECB in easing monetary policy. It is seeking to spur lending and boost consumption after having to rein in a credit boom that has slowed economic growth to a 13-year low. But with the announcement that the Prime Minister's office had given its approval for the creation of the Vietnam Asset Management Company - a Vietnamese version of the Resolution Trust Co. used in U.S. liquidations - it may be that the country is getting serious about cleaning up the balance sheets of its biggest and weakest banks.

The effectiveness of the VAMC will be limited by the size of the company. We've heard reports of a paltry $24 million as the initial chartered capital. If that is the case then this is more PR than it is reform, at least initially. If this money flows to the smaller agricultural banks then that money will have its maximum effect in the shortest amount of time. Vietnam's exports are dominated by coffee, tra fish, rice, rubber and cashews and the high interest rates needed to prick the housing and investment bubble have been devastating to farmers' ability to carry costs through the last two growing cycles.

Up to this point, outside of the strong monetary policy and moves to control the flow of gold (GLD) in country, there has been a lot of discussion but very little action to clean up the large inventory of non-performing loans which are the source of the economic malaise. In the past year, the State Bank of Vietnam has cut interest rates from 13% to 6% in the hopes of engineering a soft landing. Given the number and size of NPLs (officially 4.5% of all loans, unofficially double or triple that number) and bankruptcies (more than 113,000 in two years) that outcome was simply not in the cards.

The latest 100 basis point cut in key rates is likely the last after 7 previous ones. The economy is simply too weak to support lower rates without engendering hyperinflation of the Dong.

The VN index climbed 0.1% on last Friday to close at 500.24, its first weekly close above 500 since April 5th. It has since followed through, threatening the April 10th high at 518.46. It has performed well so far this year and has not repeated last year's Q2 sell off after a strong Q1. The index has returned 21% year-to-date. A weekly close above that April 10th high would be a bullish breakout signal that the latest policy moves have been embraced by investors, primarily foreign institutional ones, who have been actively accumulating all year on the hope that Vietnamese regulators would get serious about cleaning up the debt problems.

The Market Vectors Vietnam Index ETF (VNM) has risen 16.8% this year and like most single country ETFs is heavily weighted towards financial institutions. AUM has risen $103 million, or 29.3%. Clearly there is a lot of speculative bottom-fishing going on in Vietnamese stocks currently. (click to enlarge)

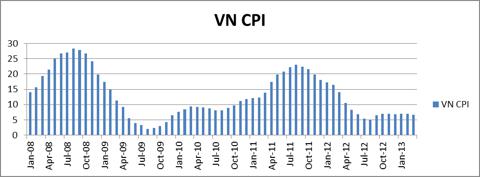

Vietnam's Consumer Price Index came in at 6.36% in May after rising 6.62% in April but even with bringing it down from 20+% at the start of 2012, real interest rates for Dong-denominated deposits are hovering at around positive 1% for 1-month term deposits. Demand deposits are still around -4%.

With all of the turmoil in the Japanese government bond market and yields rising around the world, Vietnam's government bonds have been the latest recipient in the search for yield. 5-year bonds hit their lowest yield since 2007 coming down to 8.11%.

A steeper yield curve has been elusive for Vietnam over the past year. Interbank rates have finally returned to something approaching normal, but as we can see from the data below, the money markets are very volatile in the short term and the SBV is active week to week, keeping the system from locking up.

Vietnam Money Market Rates 5/24/2013 | |||

Days to Term | Rate | Change MTD | Change YTD |

1 | 0.91% | -3.50% | -1.47% |

7 | 1.10% | -3.82% | -1.69% |

14 | 1.47% | -3.68% | -1.88% |

30 | 2.84% | -3.23% | -1.40% |

60 | 4.21% | -2.44% | -0.89% |

90 | 4.60% | -2.88% | -1.09% |

180 | 6.02% | -1.86% | 0.02% |

270 | 7.25 % | -1.45% | -1.25% |

360 | 8.00% | -1.50% | -0.80% |

The decision to create a Vietnam Bad Bank is an excellent move as are the reforms to land use and investment laws currently under review which may be approved this fall and the Party Plenum. If that occurs, it will increase foreign investment returns and opportunities and the VN Index will likely rise.

The IMF lowered its projection for Vietnam's growth to 5.2% this year from 5.8% previously and to 5.2% in 2014 from 6.4%, putting its growth behind its ASEAN peers like Indonesia, Myanmar and Thailand. The Philippines last week received an investment grade rating from Standard & Poor's while Indonesia's economy grew 6.02% in the first quarter - but Indonesia is suffering from a mix of problems that are similar to both India -- high current account deficit from fuel subsidies -- and Vietnam -- extreme credit growth.

However, Vietnam's import demand has been curbed by slower economic growth and the country's balance of trade has improved so far in 2013 --though trade deficits returned in March and April coming in at $1 billion, mostly in the form of gold imports. A stronger trade balance has helped keep the Dong from depreciating further throughout all of the rate cuts and slowing money velocity.

Fitch estimates that the cost of recapitalization of the banks may reach 10% of 2012's GDP with the aim of lowering the NPL ratio to 3% by 2015. But, against this backdrop, the SBV will offer a VND 30 trillion ($1.44 billion) package to provide cheap credit to home buyers and support the real-estate sector which will only work against any of the good done by finally pulling some of the bad debts out of the banking sector.

For now, Vietnam still looks like a country in transition. Its credit bust was one for the ages and it will take a lot more work to sort it all out. Watch the VN Index for directional signs. 520 is an important level to the upside while the recent double bottom at 466 is near-term support in a correction.

Comments