Post-merger Integration is a highly complex process. It requires swift action as well as running the core business activities  simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

It is inevitable that some elements of information will be withheld from a Buyer pre-deal. Further, not all the synergy benefits originally identified in the deal will prove to be achievable. The foremost challenge for management at the onset of the PMI process is to identify how value can be captured from the newly combined organization via synergies and cost savings.

Understanding Post-merger Integration

Post-merger Integration is the fundamental stage of realizing the value of an M&A deal. A highly complex process, it entails bringing together 2 companies experiencing change while ensuring that business continues as usual. A truly challenging undertaking that must never be underestimated.

When 2 companies agree to undertake a Post-merger Integration, its primary objective is to maximize synergies to ensure that the deal lives up to its predicted value. It is a phase during which the results of the Buyer’s M&A strategy and expectations for the closed deal start to materialize.

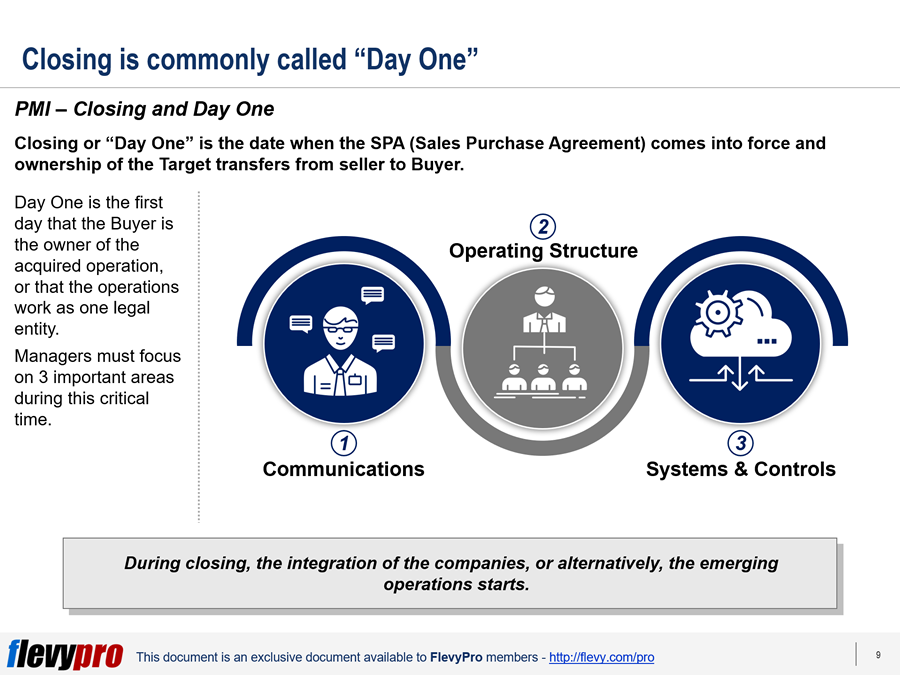

In the entire phase, Closing and Day One of change is the most critical. It is the initial starting point towards the change of ownership and where Strategy Development is at its core.

Closing and Day One

During Closing and Day One, Managers must focus on 3 important areas.

- Communications. Corporate Communications must be well planned and well implemented. This is to enable managers to lead an M&A project more effectively. Through structured communication, trust is built, motivation developed, and important information shared. In fact, it can prevent the negative impact of rumors and unify the different parts of the joint company.

- Operating Structure. New operating structures and systems are made once the joint company’s strategy and goals have been agreed upon. From Day One, it is important that new management and operational structure/reporting procedures are clearly communicated. In the development of the operating structure, it is important that a CEO has been appointed, the key personnel roles decided, and there is already an agreement on operative and statutory structures.

- Systems & Controls. A clear and detailed Systems & Controls must be established by Day One. This is essential for management to be able to gain control of the operations of the Target. If operational structures are not finalized at this point, a temporary management system and control need to be established.

The Important Role of a CEO and Key Personnel from Day One

The CEO plays a vital role in the joint business. The CEO or Managing Director is involved in the acquisition process. Hence, it is important that from Day One, a CEO or Managing Director has already been appointed.

Often the CEO comes from the Buyer or its group or corporate entity. If an existing CEO of the acquired entity continues the same role, then the Buyer must nominate a controller to ensure financial integration and smooth reporting.

The Key Personnel is also essentially important from Day One. In fact, there is a need for positions and roles of key personnel during the integration process to be planned in advance and communicated at closing.

Interested in gaining more understanding of PMI Day One Activities? You can learn more and download an editable PowerPoint about Post-merger Integration (PMI): Day One Activities here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Comments