Post-merger Integration is a highly complex process. It requires swift action as well as running the core business activities  simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the identification and capturing of synergies will help maximize deal value.

Because of the complexity of the PMI process, it is of utmost importance that organizations—both the Buyer and Target, the integration team, and integration manager—have a guide that will provide them the detailed requirements of the process. The Post-merger integration framework has a structured approach that can direct attention to important integration areas to maximize deal value and achieve Operational Excellence. The inability to focus on priority areas can be a waste of resources, time, and investments.

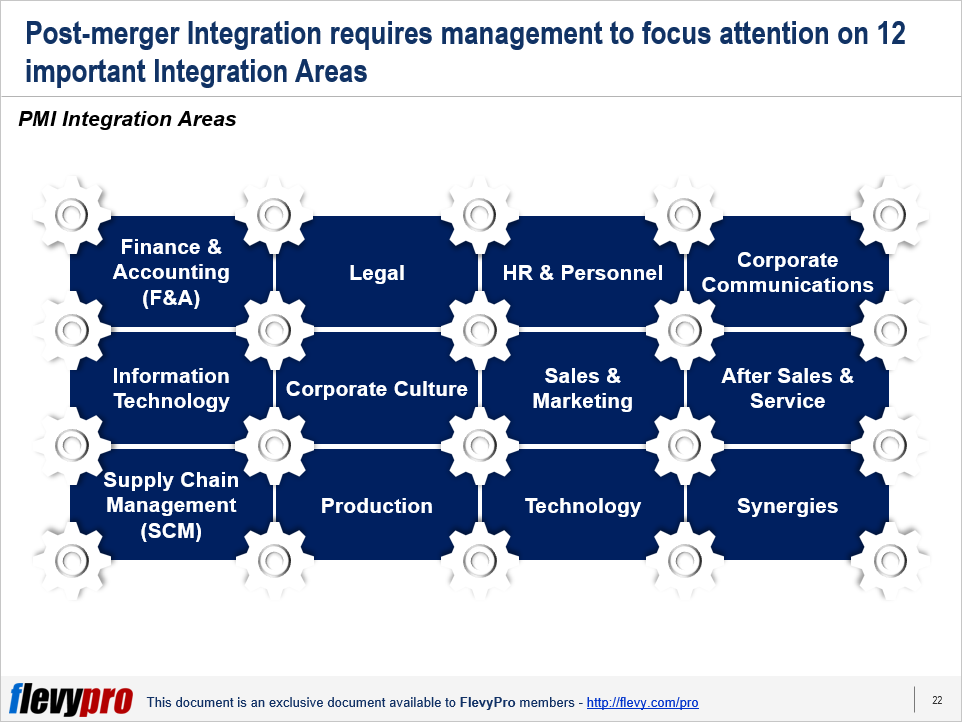

The 12 Integration Areas

The Post-merger Integration framework drives a structured approach to identify important Integration Areas to focus on during the transition. There are 12 Integration Areas that need to be prioritized.

The first 2 integration areas within the full checklist:

- Finance & Accounting (F&A). This is an integration area that is focused on establishing the financial sustainability of the new organization. Financial & Accounting needs clear instructions and templates for financial reporting at Closing. The better the information, the few surprises there are due to poor reporting or absence of data. Financial & Accounting has 9 sub-areas that are essentially important for organizations to have a good appreciation and understanding of.

- Legal. The role of the legal function does not end at the Closing. Many legal items need to be listed and considered immediately after the Closing. Special events, such as acquisitions of minority shares or the formation of joint venture companies must be considered. Legal is one vital area in building the sustainability of the new organization.

The next 2 integration areas within the full checklist:

- HR & Personnel. Integral in the Integration Process, HR & Personnel is a key area in integration. Management of the HR Integration Team is a primary responsibility of the Buyer’s HR manager. There are 5 sub-areas under HR & Personnel that must be given important consideration.

- Corporate Communications. Successfully using the Buyer’s and Target’s corporate communication functions for announcing and explaining PMI progress is a net sum of many factors. Essentially, communicating PMI progress requires the effective use of the corporate communication functions of both Buyer and Target.

The third 3 integration areas within the full checklist:

- Information Technology (IT). The goal of the ICT Integration Process is to link the ICT networks of the acquired entity with the Buyer’s corporate ICT network. It is necessary to facilitate access to systems and services provided by the Buyer and collaborate with business/market areas. Often, the integration process is let by an ICT individual from the Buyer’s corporate/company ICT or business/market area ICT.

- Corporate Culture. Corporate culture has increasingly become a critical factor in integration success, particularly in cross-border M&A. An M&A deal often impacts on corporate culture, both on the Buyer’s and the Target’s side.

- Sales & Marketing. This is a difficult sensitive area to be changed in the integration process. Sales & Marketing contribute largely to organizational financial stability, hence primary consideration must be undertaken.

The last 5 PMI integration areas within the full checklist:

- After Sales & Service. This is increasingly becoming important in value creation. It is an added-value that strengthens Sales & Marketing capability to sustain the market.

- Supply Chain Management (SCM). This is undertaken at a later phase of integration as the fundamental change requires detailed planning and calculation.

- Production. This is one critical area where more experience and planning are required in decision making.

- Technology. The extent to which the integration focuses on Technology and R&D depends on the M&A strategy. If the purpose of the acquisition is to gain technology or strengthen existing capabilities, then this is when the integration will focus on technology.

- Synergies. This an integration area that can mean new strengths and opportunities from combined knowledge and experiences.

Organizations must take adept steps in undertaking the Integration Checklist as this will enable both the Buyer and the Target to reach the most strategic state necessary for the 12 Integration Areas.

Interested in gaining more understanding of the Post-merger Integration (PMI) Integration Checklist? You can learn more and download an editable PowerPoint about Post-merger Integration (PMI) Integration Checklist here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Comments