Value-Based Management (VBM) has been regarded traditionally as a tool to help investors evaluate firms, optimize performance management, and maximize shareholder value.

However, there are mixed opinions on whether to utilize VBM as a mandatory investment or management tool. Many investors, analysts, and executives, to this day, are skeptical of the influence and role of VBM in confronting the dot-com bubble or other financial downturns. They are even cynical of the efficacy of VBM as a robust management approach for the future or its effectiveness in creating competitive advantage for them.

The following are some shortcomings associated with the traditional VBM approaches that leaders should negotiate:

- An inadequate link between VBM practices and capital markets realities—absence or lack of analysis of the capital markets to expose gaps between a company’s intrinsic value and actual stock price.

- Aligning VBM with the organizational systems and its culture for value creation.

- A broken process for managing the controls that govern value creation—traditional VBM offers rich insights on managing economic principles, but lacks a process on how to further align strategic, cultural, and behavioral levers.

Value Creation Framework

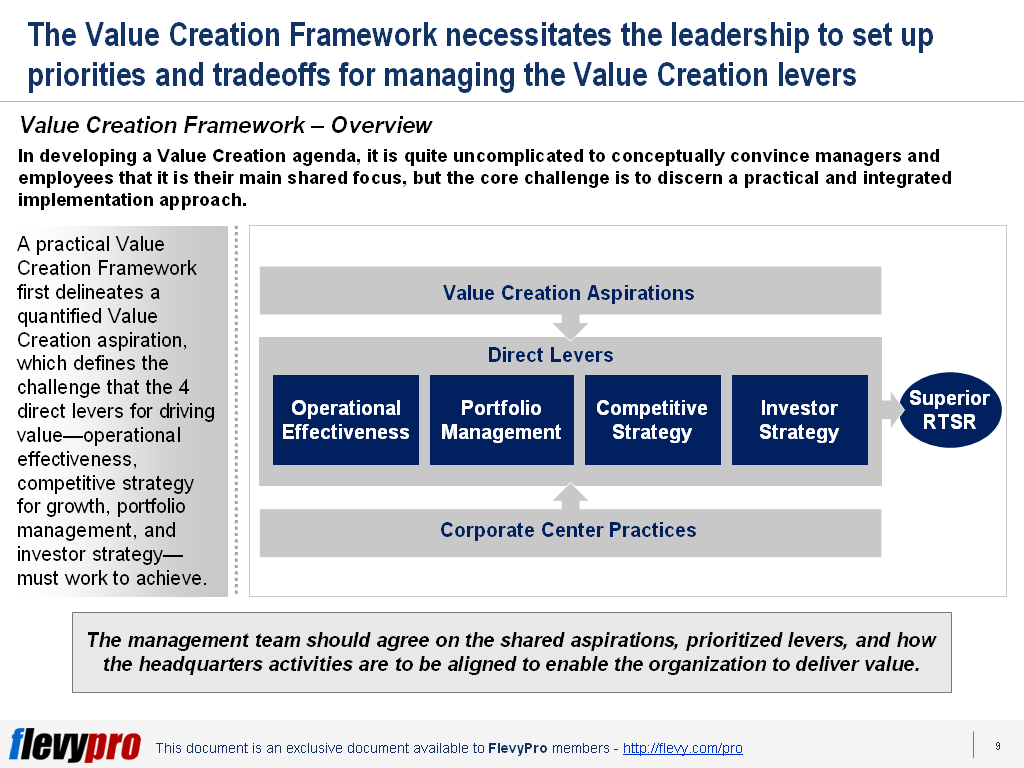

The lack of trust in the effectiveness of VBM necessitates formulating a more thorough, fact-based approach to executing VBM. In developing a value creation agenda, it is quite uncomplicated to conceptually convince managers and employees that it is their main shared focus, but the core challenge is to devise a practical and integrated implementation approach.

The Value Creation Framework depends on 4 value creation levers that senior management can pull in order to effectively achieve their value creation goal. These levers are not autonomous and needs to be activated in tandem:

- Operational Effectiveness

- Competitive Strategy

- Portfolio Management

- Investor Strategy

The framework first stresses the management team to agree on the shared aspirations, prioritized levers, and how the headquarters activities are to be aligned with the business units. This entails revisiting the assumptions, priorities, decisions, tools, and culture at all levels across an organization to harness VBM to achieve improved value creation. The framework warrants the VBM approach to be embraced as a culture to maximize value creation--which is measured in Relative Total Shareholder Return.

Relative Total Shareholder Return (RTSR)

Focusing and aligning the organizations around a shared mission is important for the leadership. Clearly laid out, compelling vision and aspirations—that are reinforced daily—have a profound positive impact on an organization’s value creation potential.

Value creation best practices necessitate establishing a single, long-term goal—the Relative Total Shareholder Return (RTSR) performance. The Relative Total Shareholder Return reflects a firm’s capital gains plus dividend yield relative to a peer group or market index.

The RTSR concept is not new, but practically most companies find it hard to implement RTSR as a goal-setting tool. The RTSR should be clearly quantified and communicated across the board as a long-term goal. The RTSR aspirations motivate and empower line management to work as entrepreneurs to achieve it, set objective targets, and connect business unit management to capital markets discipline. If done right, RTSR is a useful method to specify and communicate a firm’s objectives and the supporting execution plans.

Measuring RTSR Objective

Measuring the RTSR goal achievement at the corporate level can be done by ranking a firm’s TSR against its peers TSR. A RTSR target can be set to analyze the effect of corporate and business unit plans. This can be done by quantifying a subjective goal—e.g., top half or top quartile TSR—into a specific number. The calculations warrant developing a forward-looking RTSR target on the following 3 footings:

- Anticipated 5-year company cost of equity—to gather an investor’s view of the risk-adjusted average expected return that a firm or market index is priced to deliver.

- Anticipated spread to achieve relative TSR goal—calculating stretched, above-average TSR goal needs personal discretion. It can be done through superior performance improvements instead of maintaining superior absolute levels of performance.

- Forward looking 5-year RTSR target—calculation of this goal requires 2 key considerations: RTSR probability of reaching above-median TSR and benchmarks to meet a cumulative top quartile TSR target over different time periods.

Interested in learning more about the Value Creation Framework? You can download an editable PowerPoint on Value Creation: Relative Total Shareholder Return here on the Flevy documents marketplace.

Are you a Management Consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Comments