|

| Get Tax Aware risk: tax code, tax audit, regulatory compliance, accounting, legal, |

Its that time of year again. April 15th looms ever larger as small businesses scramble to meet the IRS tax filing deadline. For many small businesses, tax filing is handled by a trusted accountant or business adviser. That tends to take the trauma out of this annual exercise in pain. But even with the help of a tax professional the angst of the season is always a pressing concern.

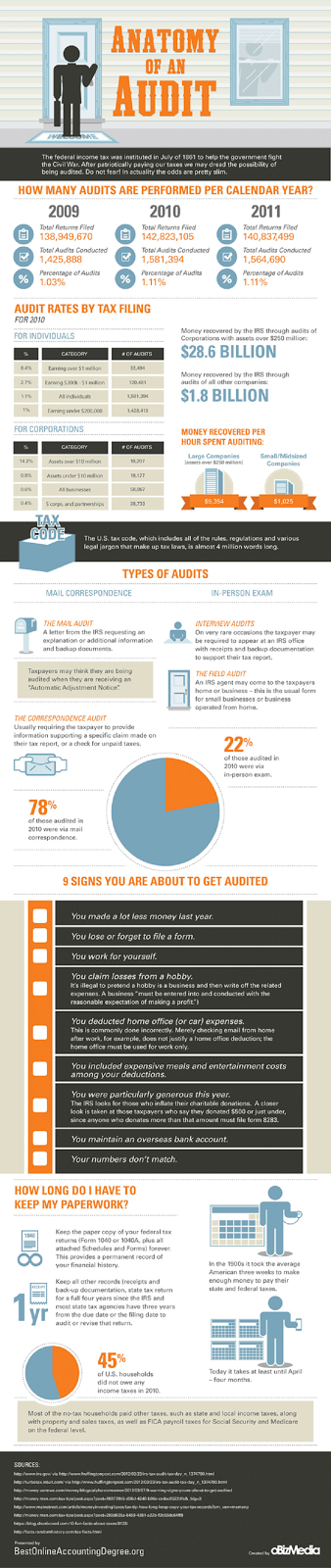

The enclosed infographic published by oBizMedia, displays some startling data about audit risk and its cost to small businesses. For example in 2011 over 50,000 small businesses were audited by the IRS. The IRS recovered over $30 billion in taxes as a result of auditing business returns. A considerable sum of money that small businesses once counted as profits now paid to the tax man. That can turn a good year of business into a not so good year.

Its only natural that during times of economic adversity all business owners want to keep as much as they can. During these times some business owners may be a bit more aggressive in its tax strategy to minimize tax liability. It's a risk that unfortunately can come back to haunt SME's with additional tax liabilities, fines, penalties and costly litigation.

As the tax filing deadline approaches it is important to keep in mind the various audit risk factors certain deductions raise with the IRS. In the past the agency has published guidelines agents utilize to risk profile tax returns. Claiming these deductions heightens the risk of an audit by the IRS. It is a critical that SMEs are aware of these audit risk factors and incorporate this intelligence into its tax filing strategies.

Sum2 developed the IRS Audit Risk Program (IARP) to provide SME’s an audit risk assessment tool to keep the taxman away from the door. IARP outlines tax code focus areas where caution should be exercised when filing tax returns. Business owners can rest a bit more easy that audit risk is being effectively managed. Get Tax Audit Aware with IARP.

*Be sure to consult with your tax adviser for guidance on tax strategy and audit sensitivities specific to your business

You need to be a member of Global Risk Community to add comments!

Comments