Changing industry ecosystems and competition today demand from the organizations to undergo strategic shifts. The purpose of a company is undergoing Business Transformation from serving the interest of shareholders to serving all stakeholders that influence the organization.

Shareholders are often considered the only stakeholders that invest in a business. Senior management needs to be cognizant of the importance of shareholders as well other stakeholders who create value for the organization. They should work on building a collaborative Organizational Culture and paying heed to the welfare of all those groups that play a role in organizational growth.

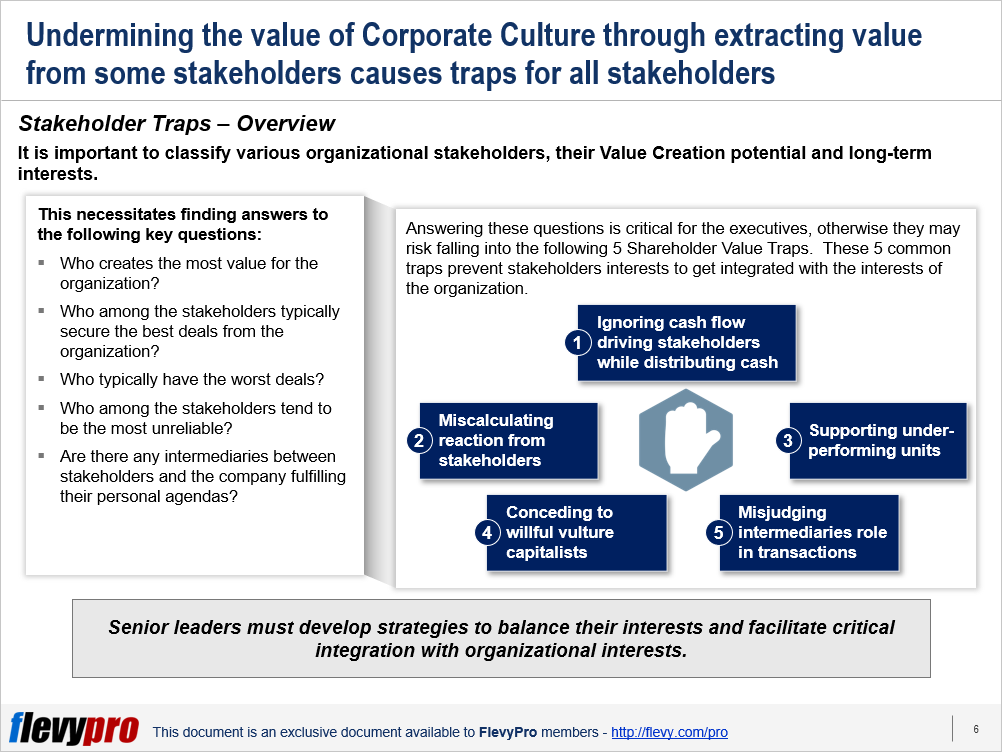

This warrants a thorough evaluation of all stakeholders, their long-term interests, and Value Creation—or Value Destruction—potential for the organization. But first, this calls for finding answers to the following key questions:

- Who creates the most value for the organization?

- Who among the stakeholders typically secure the best deals from the organization?

- Who is the victim of having the worst deals from the organization?

- Who among the stakeholders is potentially untrustworthy?

- Are there any intermediaries or stakeholders fulfilling their personal agendas?

Answering these questions is critical for the executives, otherwise they may risk falling into Shareholder Value Traps. Recognizing and understanding stakeholder value traps while managing stakeholders' various interests helps executives achieve shared and individual long-term goals. These 5 common traps prevent stakeholders’ interests to get integrated with the interests of the organization and destroy the value of a company if overlooked:

- Ignoring cash-flow driving stakeholders while distributing cash

- Miscalculating reaction from stakeholders

- Supporting under-performing units

- Conceding to willful vulture capitalists

- Misjudging intermediaries role in transactions

Let’s discuss 3 of these stakeholder traps individually.

TRAP 1 – Ignoring cash-flow driving stakeholders while distributing cash

Shareholders are often treated as the critical drivers of long-term cash flows. However, they are often short-term cash flow generators, whereas other stakeholders who provide their input for the organization in the form of their competencies and experience deliver long-term value. These real contributors should be given top priority when distributing cash on earnings. Underestimating or failure to identify the real long-term cash-flow generators can be a fatal value trap for an organization.

TRAP 2 – Miscalculating reaction from stakeholders

Another trap that most executives fall victim to is discounting potential backlash from weak stakeholders upon unfair distribution of cash / incentives. Mining value from these victims to support shareholder disbursements can be equally detrimental, as annoyed stakeholders—with the help of social media and NGOs—, legal battles, and financial penalties can devastate a firm’s reputation and financial health.

TRAP 3 – Supporting under-performing units

Senior executives and boards at some organizations foster free riders—stakeholders that sap more benefits from the enterprise than the business they generate—at the expense of long-term value shareholders. Free riders include an under-performing department close to the board, or a dwindling business unit that is part of a profitable section and whose financials are not categorized separately.

Continued support to these free riders is often at the cost of allocating resources to other potentially more profitable ventures, and this practice has led many companies to losses and even bankruptcies.

Interested in learning more about the Stakeholder Value Traps, types of organizational stakeholders, and strategies to stay clear of the Stakeholder Value Traps? You can download an editable PowerPoint on Shareholder Value Traps here on the Flevy documents marketplace.

Are you a Management Consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Comments