Michael Eugene Porter—a Professor at the Institute for Strategy and Competitiveness, Harvard Business School—is widely acclaimed for his unmatched prowess in competitive strategy, strategic planning, global economic development, and the application of competitive principles and strategic approaches. Renowned as the father of modern day strategy, Dr. Porter is an author of 18 books and a number of articles.

His scholarly writings on management and competitiveness are ranked as the most influential pieces of work till date. Dr. Michael Porter is widely known for his Porter’s Five Forces framework, which is a useful tool to evaluate the competitiveness of an organization with respect to its rivals. Competition is part and parcel of every industry, and for the existence of an enterprise it is important to know its rivals and how their product / service offerings and marketing strategies affect the market. It is a common foundational framework used in Strategy Development.

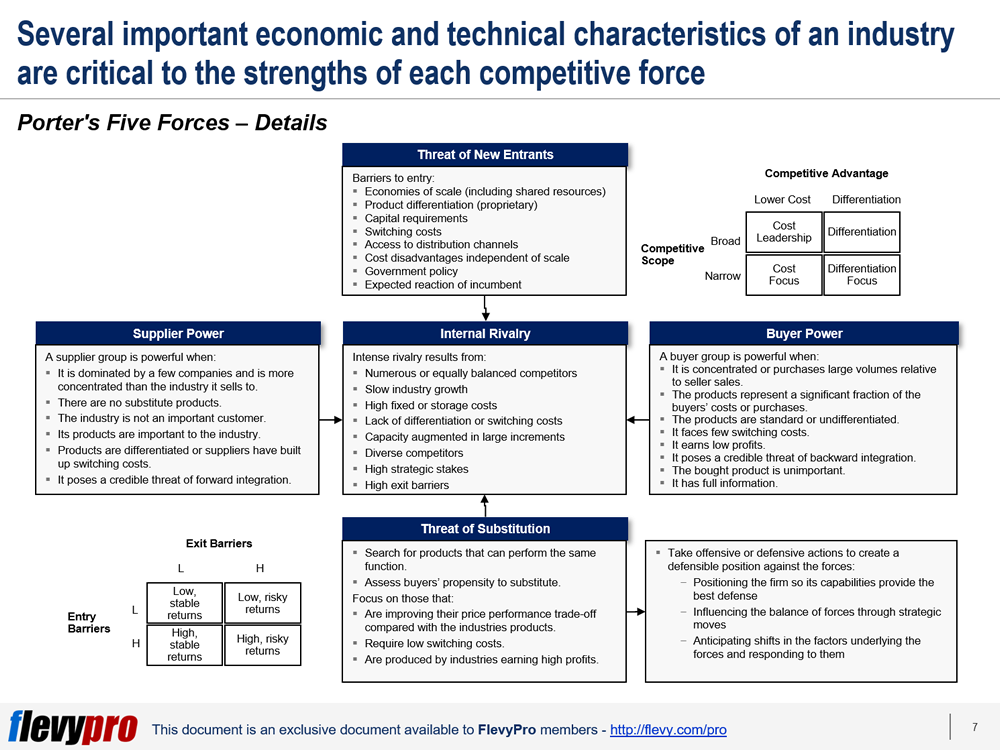

The Five Forces framework emphasizes on 5 critical elements that determine the attractiveness of a business against its rivals in the industry:

- Threat of New Entrants

- Supplier Power

- Buyer Power

- Threat of Substitution

- Competitive Rivalry

Threat of New Entrants

This element examines the simplicity or complexity of an industry for the competitors to jump in. High-return industries are more appealing to new entrants. A market with easy access for new entrants poses greater risk—of market share diminishing—for established businesses. New entrants in an industry are able to dent the profitability of established players unless the incumbents retaliate strongly and make the entry of new firms challenging.

A serious threat to entry also relies on the existing barriers in the industry. If the market entry barriers are high and there is an expected sharp response from the entrenched competitors, the newcomers will think twice before entering the market. Another important factor for new entrants is the requirement for large capital for branding, advertising and creating product demand, which limits their entry in a niche market. Aspiring market entrants should thoroughly analyze and understand all the critical barriers to entry before entering an industry—such as economies of scale, product differentiation, capital investment, access to distribution channels, and government policies and regulations.

There 6 prevalent types of barriers to entry:

- Economics of scale

- Product differentiation

- Capital requirements

- Cost disadvantages (independent of size)

- Access to distribution channels

- Government / regulatory policy

Supplier Power

Suppliers are a powerful force that influences the competitiveness of an industry. They create immense pressure on market players by slashing the quality of goods and by increasing prices, thereby squeezing the margins of manufacturers. For instance, by jacking up the price of soft drink concentrate, suppliers erode profitability of bottling companies. The bottlers, in turn, don’t have much leverage to raise their own prices because of intense competition from fruit drinks, powdered mixes, and other beverages.

The power of a supplier group amplifies if it’s dominated by a few firm, has differentiated and unique products; and has built up switching costs that buyers face when changing suppliers, for making investments in specialized equipment, or in learning how to operate a supplier’s equipment. The supplier group also thrives when there isn’t much competition for sale to the industry, or when the industry is not its major customer, as this saves the supplier from selling at a bargain and investing in R&D and lobbying for the industry.

Buyer Power

Buyer or customer groups also impact the competitiveness of an industry landscape by exercising their power to bring the prices down, insist on higher quality, or demand more service. A buyer group is powerful if it buys in large volumes in an industry characterized by heavy fixed costs and buys undifferentiated or standard products. Buyers have the ability to put one supplier against another and find alternative suppliers.

The power of a buyer group increases if it’s a low profit business—providing it the reason to be price sensitive and insist on lower purchasing costs—, if the industry’s product is insignificant to the quality of the buyers’ products or services, or if the product that suppliers provide does not save much for the buyer. Buyers can also use the threat of self-manufacturing as a bargaining lever against the suppliers.

Threat of Substitution

Substitute product or service offerings restrict the capacity of an industry by placing an upper limit on prices it can charge. The industry’s earnings and profits will continue to suffer lest it can enhance the quality of products or create differentiation through, for instance, aggressive marketing.

If substitute products offer more competitive price-performance trade-off, then the industry’s profitability gets limited or goes down. For instance, the erosion of profits for the sugar industry due to substitution of sugar with commercialized high-fructose corn syrup.

Internal Rivalry

Internal Rivalry, existing at the center of Porter's Five Forces framework, represents the competition between existing players often leads to rivals using manipulative tactics like price competition, new product launch, and advertising wars. Companies can use strategic shifts to improve their competitive position—e.g., raising buyers’ switching costs, increasing differentiation, and focusing on low fixed costs areas.

Interested in learning more about the other critical elements of the Porter’s Five Forces and their role in in determining the state of competition and profit potential of an industry? You can download an editable PowerPoint on Porter’s Five Forces here on the Flevy documents marketplace.

Are you a Management Consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

Comments