बिजनेस चलाने के लिए पैसों की व्यवस्था हर समय होना अनिवार्य होता है। कई बार कारोबारियों की माल की सप्लाई उधारी पर हो जाती है या अधिकतर पैसा कच्चा माल खरीदने में लगा दिया जाता है। कारोबारी जब अधिकतर पूंजी से कच्चा माल ले लेता है तब कारोबारी के पास पैसों की कमी हो जाती है जिसके चलते बिजनेस प्रभावित होने लगता है। ऐसे में जो सबसे भरोसेमंद विकल्प होता है वह बिजनेस लोन का।

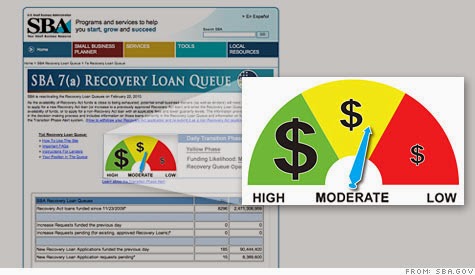

बिजनेस लोन लेकर कारोबारी अपनी आर्थिक जरूरतों को पूरा कर सकते हैं और बिजनेस को रोटेशन पर चला सकते हैं। इसी के साथ बिजनेस लोन और भी