All Posts (6240)

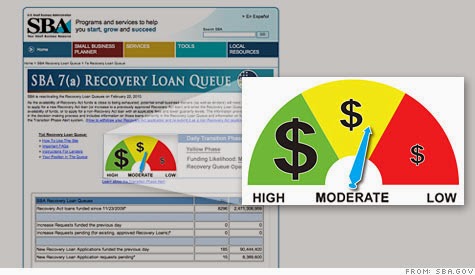

Compliance professionals have it tough. While risk managers work in shades of grey (or often, red, yellow, and green), compliance officers are often asked to answer the more direct question: Do we meet this regulatory mandate?

Compliance professionals have it tough. While risk managers work in shades of grey (or often, red, yellow, and green), compliance officers are often asked to answer the more direct question: Do we meet this regulatory mandate?

While the task may differ, compliance professionals without enterprise risk management in their toolbox are at a significant disadvantage. Regulations are changing constantly, responsibility for compliance ranges from high level executives to analysts on the front line, and

The business world is now international. Because of the far reach of constantly improving technology, businesses can communicate and work with customers thousands of miles away in real time. This reality has led to the growth and expansion of international business school programs around the world.

Shawn O'Connor, writing on Forbes.com, reports that over the past five years, a higher percentage of MBA program applicants have chosen international business schools. Notably, many of these programs

Despite the global trends demanding that individuals take greater action to manage their personal finances, a huge number of retail customers fail to either seek or use professional financial advice. In the UK, a recent survey by Yorkshire Building Society found that more than one in four savers are finding it difficult to access or afford financial advice. In the wake of the implementation of the Retail Distribution Review (RDR) in the UK, most high street banks, and many financial advisers, wi

Risk Leadership: Driving Cultural Change through Engagement

So many people that I meet for the first time from outside the risk profession have a very poor perception of risk management as a discipline. They see it as a compliance activity at best and most see it as a handbrake on business. Recently my wife described me to a new acquaintance as one of the fathers of modern risk management and the person turned to me and said, “So you are to blame!”

You and I know the value of risk management.

Terrific piece on SME lending in yesterday's Irish Independent.

More than half of all lending decisions appealed to the Credit Review Office by small and medium enterprises (SMEs) are overturned. This is a good lesson for SME's to be persistent in the face of rejection. SME's that can show confidence in their business prospects and demonstrate a creditworthiness can turn a negative decision into a green light. The key to this happy reversal of fortune is being able to provide evidence of creditwo

Since Darwin’s Origin of the Species we have recognised how nature adapts to survive. Modern humankind continues to adapt to survive while following these two innate risk management principles:

• If it hurts us we learn and take action in proportion to the degree of pain.

• The next time we face the same pain we are better prepared and we go back for more and either avoid the pain or at least find a way of working to a new pain threshold.

Why history keeps repeating itself is simple really.

SME lending just got more expensive in Singapore. Basel III capital requirements has increased the risk weighting on SME loans. Banks are now required to set aside more capital to protect against SME loan defaults. This will drive up the cost of capital for SME’s as lenders pass on added costs to borrowers to maintain healthy margins on SME loans; Singapore’s Business Times reports.

SME’s are a critical driver of economic growth in Singapore. Bank loans to the segment grew more than 10% in 2013.

Customers? They’re more connected and empowered than ever. The result? Financial services providers need to focus on the creation of customer platforms that deliver a satisfying experience, as well as the services and products they need.

What do we mean by a platform? In short, a platform seeks to provide an experience that adds value to the user experience beyond a list of services and products. A good platform also increases long- term customer engagement by adding new features and experiences

Marketplace Interview:

This Marketplace interview is relevant to the tricky issues surrounding the transformation of business culture of SME's. Since the death of Steve Jobs, Apple has been struggling with transitioning its corporate culture into a post Jobs era.

Let’s face it. Complexity is a fact of life in financial services. Mergers and acquisitions, organizational changes, and service offerings across multiple locations result in a maze of disparate and disconnected applications and platforms.

In this environment, radical action is needed to lower maintenance costs, improve operational efficiency and improve customer satisfaction. Rationalization today is mandatory to simplify and improve the way that financial institutions organize their daily busin